There are 3 types of contributions

- Infrastructure (known as Section 7.11 and 7.12, previously Section 94 and 94A)

- Sewer (Section 64)

- Stormwater (Section 64)

Contribution Plans include the contributions for development and the way they are to be applied.

Plans can be accessed below:

You can download this document by clicking the download arrow in the top left corner.

Sections 7.11 and 7.12 of the Environmental Planning and Assessment Act 1979 (EP&A Act) authorise Council to require contributions from developers for local infrastructure as part of their development approvals. Council may only impose a contribution if it is allowed by and determined in accordance with this Plan.

This Plan’s main purpose is to authorise Council to impose conditions on development consents or complying development certificates requiring Section 7.11 contributions or Section 7.12 fixed rate levies from development to which the Plan applies.

The contributions in this Plan will be applied from 1 July 2019 to deliver the schedule of infrastructure land and works shown in Appendices A and B of the Plan.

Addendum to Local Infrastructure Contributions Plan 2019-2034 - May 2024 121.7 KB Download

Addendum to Local Infrastructure Contributions Plan 2019-2034 - 14 September 2020 9.9 KB Download

Section 64 of the Local Government Act 1993 enables a Council to Levy developer charges for water supply, sewerage and stormwater.

A Development Servicing Plan (DSP) is a document which details the water supply, sewerage and/or stormwater developer charges to be levied on development areas utilising a water utility's water supply, sewerage and/or stormwater infrastructure.

The DSP's cover stormwater and sewerage developer charges in regard to the development areas served by Wagga Wagga City Council.

The DSP's have been prepared in accordance with the Developer Charges Guidelines for Water Supply, Sewerage and Stormwater (2002) issued by the Minister for Land and Water Conservation, persuant to Section 306 (3) of the Water Management Act 2000.

The DSP's supersede any other requirements related to water supply and sewerage developer charges for the area covered by the DSP's. The DSP's take precendence over any of Council's codes or policies where there are any inconsistencies relating to sewerage developer charges.

Development Servicing Plan - Sewerage 7.6 MB Download

Addendum to Wagga Wagga City Council Development Servicing Plan - Sewer 2013 159.5 KB Download

Section 64 of the Local Government Act 1993 enables a Council to Levy developer charges for water supply, sewerage and stormwater.

A Development Servicing Plan (DSP) is a document which details the water supply, sewerage and/or stormwater developer charges to be levied on development areas utilising a water utility's water supply, sewerage and/or stormwater infrastructure.

The DSP's cover stormwater and sewerage developer charges in regard to the development areas served by Wagga Wagga City Council.

The DSP's have been prepared in accordance with the Developer Charges Guidelines for Water Supply, Sewerage and Stormwater (2002) issued by the Minister for Land and Water Conservation, persuant to Section 306 (3) of the Water Management Act 2000.

The DSP's supersede any other requirements related to water supply and sewerage developer charges for the area covered by the DSP's. The DSP's take precendence over any of Council's codes or policies where there are any inconsistencies relating to sewerage developer charges.

Development Servicing Plan - Stormwater - 2007 7.8 MB Download

DSP Stormwater Implementation Guide 161.8 KB Download

Development Servicing Plan - Stormwater November 2007 - Background 7.7 MB Download

Addendum to Wagga Wagga City Council Development Servicing Plan - Stormwater 2007 24.1 KB Download

Section 93F of the Act makes provision for Council to enter into Voluntary Planning Agreements as the means through which these additional community facilities are provided. Under these agreements, Council enters into a legal contract with a developer to construct public facilities and infrastructure or provide public services as part of the conditions of development consent.

Section 25F (1) and (2) of the Environmental Planning and Assessment Regulation 2005, states that a Council must keep a planning agreement register.

Council must keep a record of the following in its register:

- a short description of any planning agreement (including any amendment) that applies to the area of the Council,

- the date the agreement was entered into,

- the names of the parties, and

- the land to which it applies.

Access the register:

What are Infrastructure Contributions?

What does Section 7.11 and 7.12 mean?

Sections 7.11 and 7.12 of the Environmental Planning and Assessment Act 1979 (EP&A Act) authorises councils and other consent authorities to require contributions from developers for local infrastructure as part of their development approvals. Councils and accredited certifiers may only impose a contribution if it is of a kind allowed by and determined in accordance with a contributions plan.

What is the Local Infrastructure Contributions Plan?

The Local Infrastructure Contributions Plan is a 15 year plan which sets outs Section 7.11 and 7.12 infrastructure contributions, how these contributions will be applied and how they will be allocated to infrastructure required to support development.

Specifically, it includes the following:

- A schedule of contribution rates for various types of development

- Information in the relationship between the expected future development and the demand for local infrastructure, including how the nexus -based section 7.11 contribution rates were calculated

- The Council's policies on how and when developers can settle their development contributions obligations, including opportunities, for developers to dedicate infrastructure, land and provide works in kind

- Specific provisions on the role of accredited certifiers in imposing and collecting development contributions

- Provisions to ensure the fair and transparent administration of development contributions received under the plan.

What is the purpose of the Local Infrastructure Contributions Plan?

The main purpose of this plan is to authorise:

- The consent authority, when granting consent to an application to carry out development to which the plan applies; or

- The Council or an accredited certifier, when issuing a CDC for development to which the plan applies,

To require either a contribution (under Section 7.11 of the EP&A Act) or a fixed development levy (under Section 7.12 of the EP&A Act) to be made toward the provision, extension or augmentation of local infrastructure required as a consequence of development in the Wagga Wagga Local Government Area (LGA). The contribution or levy may also be applied towards existing local infrastructure that was provided in anticipation of, or to facilitate, such development.

Other purposes of this plan are as follows:

- To provide the framework for the efficient and equitable determination, collection and management of development contributions in Wagga Wagga LGA

- To establish the relationship between the expected development and proposed local infrastructure to demonstrate that the section 7.11 contributions, required under the plan, are reasonable

- To allow the opportunity for local infrastructure to be provided by land developers as works in kind, in lieu of paying a monetary contribution

- To allow the opportunity for the dedication of land by land owners at no cost to Council, in lieu of a monetary contribution

- To ensure that the broader Wagga Wagga community is not unreasonably burdened by the provision of local infrastructure, that is required as a result of development in the Wagga Wagga LGA.

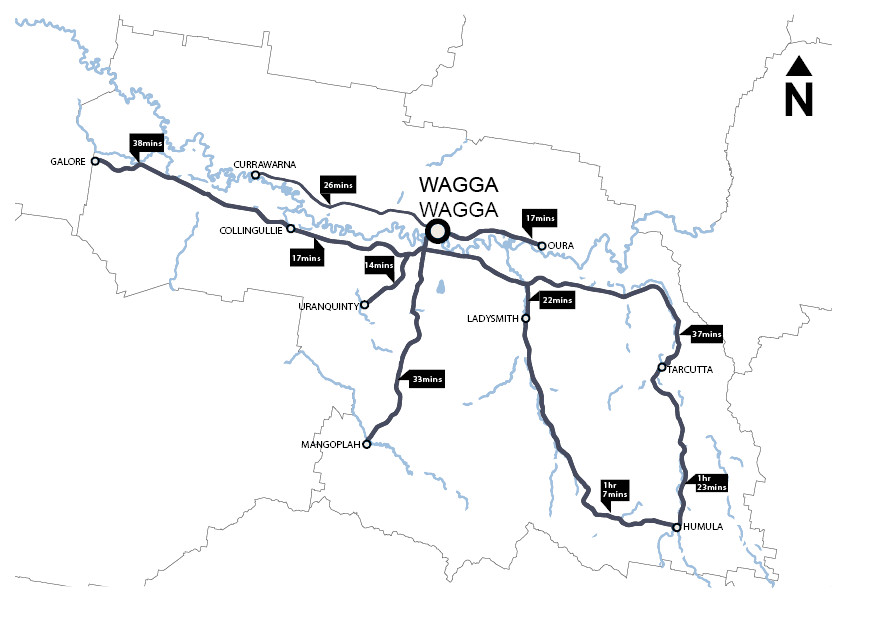

What land does the Local Infrastructure Contributions Plan apply to?

This plan applies to all land in the Wagga Wagga LGA.

Within this area are discrete contribution catchments. The catchments reflect the nexus between anticipated developments and the different infrastructure items included in the plan.

The catchments are:

- Estella, Boorooma and Gobbagombalin

- Forest Hill

- Lloyd

- Other Wagga Wagga (being all the land in the LGA outside of the above catchments).

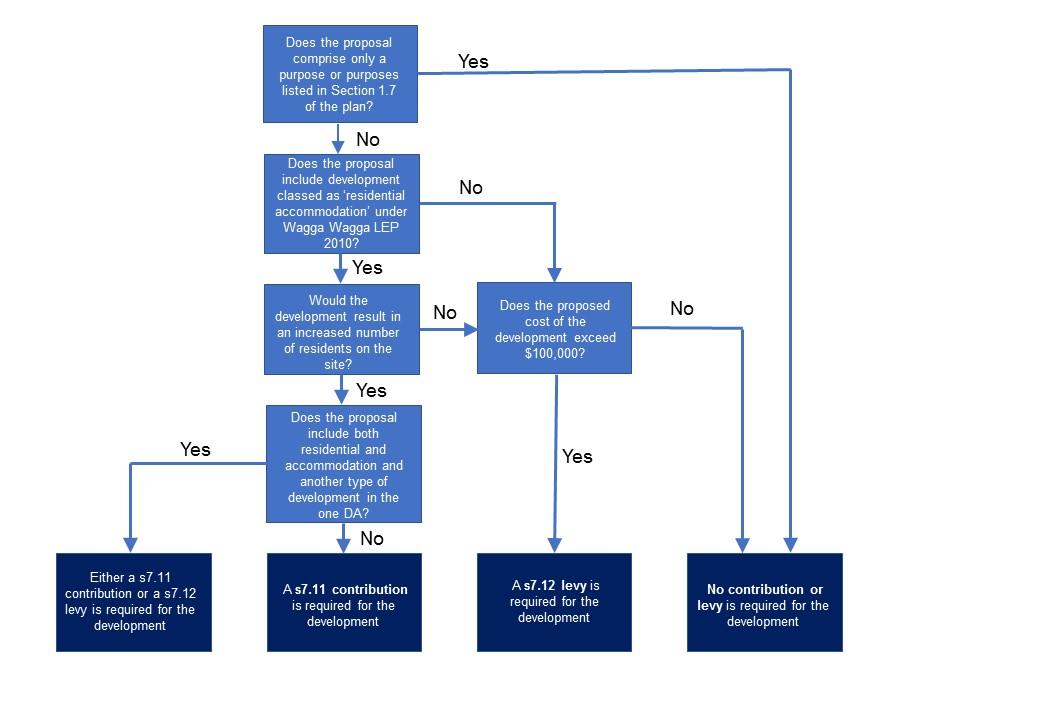

When is Section 7.11 or Section 7.12 charged?

What is residential accommodation?

Residential accommodation developments (including the subdivision of land) that would result in a net increase in residents on the land, will be subject to a condition requiring a contribution imposed under section 7.11 of the EP&A Act.

For the purpose of the plan, 'residential accommodation' means a building or place used predominantly as a place of residence and includes any of the following:

- attached dwellings

- boarding houses

- dual occupancies

- dwelling houses

- group homes

- hostels

- multi-dwelling houses

- residential flat buildings

- rural workers' dwellings

- semi-detached dwellings

- Seniors housing

- shop top housing

What is mixed use development?

A single development application can only be the subject of either a section 7.11 contribution or a section 7.12 levy, not both. Where a single development application comprises a mix of residential accommodation and other development, the component that represents 51% or more if the share of gross floor area (GFA) of the proposed development shall inform which contribution method applies. Where the GFA is a 50/50 split, section 7.11 contributions will apply.

Sewer DSP FAQ's

What are Section 64 sewer infrastructure contributions?

Section 64 refers to section 64 of the Local Government Act. This allows Councils to charge section 64 sewer infrastructure contributions.

When are s64 sewer charges levied?

Details of timing will be specified in the development application for the development

For subdivisions, payment will be required for the release of a subdivision certificate.

For any development not involving subdivision but where a construction certificate is required, payment will be required prior to the release of a construction certificate.

Where do s64 sewer contributions apply?

Sewer DSP Area 0 Bytes Download

What are the contributions used for?

S64 sewer contributions are held in a restricted reserve by Council. The funds collected are used to deliver sewer infrastructure projects identified in the Sewer Development Servicing Plan (DSP).

Stormwater DSP FAQ's

What are Section 64 stormwater infrastructure contributions?

Section 64 refers to section 64 of the Local Government Act. This allows Councils to charge section 64 stormwater infrastructure contributions.

When are s64 stormwater charges levied?

Details of timing will be specified in the development application for the development

For subdivisions, payment will be required for the release of a subdivision certificate.

For any development not involving subdivision but where a construction certificate is required, payment will be required prior to the release of a construction certificate.

What are the contributions used for?

S64 stormwater contributions are held in a restricted reserve by Council. The funds collected are used to deliver stormwater infrastructure projects identified in the Stormwater Development Servicing Plan (DSP).

If you would like more information about s64 sewer and stormwater infrastructure contributions, please contact Council's Contributions Coordinator.

The below Fees and Charges are applicable to development that will occur in the 2022/23 Financial year.

Applies to all planning proposals, development applications and complying development certificates determined after 1 July 2019

Contribution rates for development subject to section 7.11 contributions.

2022/23 Charges calculated as Base Rate (2019) X March 2022 CPI (123.7) / Base Rate (115.1).

| Catchment | Per Residenta | Per self-contained dwelling in a seniors housing developmentb | Per 1 bed dwelling | Per 2 bed dwelling | Per standard subdivision lot, dwelling house and 3 or more bed dwelling |

|---|---|---|---|---|---|

| Estella/Boorooma/Gobbagombalin | $7,677 | $11,516 | $11,516 | $15,354 | $19,961 |

| Forest Hill – East Wagga Wagga | $4,439 | $6,658 | $6,658 | $8,876 | $11,539 |

| Lloyd | $7,459 | $11,189 | $11,189 | $14,918 | $19,393 |

| Other Wagga Wagga | $4,139 | $6,208 | $6,208 | $8,277 | $10,760 |

A) the per resident rate is relevant to calculating the contributions for boarding houses, group homes, and hostels. For these developments it is assumed that there is one resident per bed.

B) seniors self-contained dwellings are charged this rate regardless of dwelling size.